HIGH SALT TAX ;AND 32000 KM CUSTOM BARRIER 1870

Ek Phirangi Raja

Ek Phirangi Raja

It

is impossible to know how many died from salt deprivation in India as a

result of the salt tax as salt deficiency was not often recorded as a

cause of death and was instead more likely to worsen the effects of

other diseases and hinder recoveries.[67] It

is known that the equalisation of tax made salt cheaper on the whole,

decreasing the tax imposed on 130 million people and increasing it on

just 47 million, leading to an increase in the use of the mineral.[68] Consumption

grew by 50 percent between 1868 and 1888 and doubled by 1911, by which

time salt had become cheaper (relatively) than at any earlier stage of

Indian history.[69]

It

is impossible to know how many died from salt deprivation in India as a

result of the salt tax as salt deficiency was not often recorded as a

cause of death and was instead more likely to worsen the effects of

other diseases and hinder recoveries.[67] It

is known that the equalisation of tax made salt cheaper on the whole,

decreasing the tax imposed on 130 million people and increasing it on

just 47 million, leading to an increase in the use of the mineral.[68] Consumption

grew by 50 percent between 1868 and 1888 and doubled by 1911, by which

time salt had become cheaper (relatively) than at any earlier stage of

Indian history.[69]

..............................................................................

Gandhi on the Salt March to Dandi of March 1930

Ek Phirangi Raja - Chutki Bhar Namak Paseri Bhar Anyay: The story of Frederick Wilson and the Great Indian Hedge[ customs barrier made of trees, hedges and bushes, manned by 12,000 personnel, to facilitate the collection of this heavy salt tax. ]

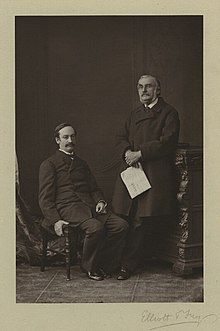

In

this essay, Romesh Bedi recounts the true story of Frederick E Wilson, a

British army officer, who deserted the army after the Sepoy Mutiny of

1957, escaped to the Himalayas, and settled in Harsil, a remote village

in Uttarakhand on the banks of the Bhagirathi.

Wilson

makes a flourishing business from the export of skins, fur, musk from

the region, and rips the local deodar forest, to cash in the growing

demand for wooden sleepers during the expansion of the Indian railways

by the British, which were sent down to the plains through the rivers.

Wilson soon acquires a lease from the Raja of Tehri-Garhwal, for his

timber business and keeps the Raja happy by giving him a share of the

profits, and even begins to mint his own local currency, because of

which locals start calling him Raja.

Wilson's

huge mansion in Hursil now belongs to the Forest Department, and his

Charleville Hotel in Mussoorie now is the site of the Lal Bahadur Shastri National Academy of Administration (LBSNAA). The main purpose of the Academy today is to train officers of the Indian Civil Services.

Considering

the sorry state of affairs of the country and the rampant corruption,

the author concludes that though the tiger (British and Wilson) has

left, the tiger's character in the form of the Indian Administration

which took its place, continues to remain, and most of all, its striking

that these administrators graduate out of the Academy that Wilson

built.

Chutki Bhar Namak Paseri Bhar Anyay

The

story of the high salt tax imposed by the British, which deprived

several Indians of a commodity as basic as salt and impacted their

health for generations, and the march led by Gandhiji to Dandi to make

salt and defy the law, is well known.

What

is not so well known is the story of the Great Indian Hedge, a 3200 km

customs barrier made of trees, hedges and bushes, manned by 12,000

personnel, to facilitate the collection of this heavy salt tax. In this

essay, Irpinder Bhatia, tells the story of British author Roy Moxham's

efforts and experiences, in unearthing the existence of this cruel

instrument of oppression, and putting the bits of information together

as a book, The Great Hedge of India (2001).

The route of the 1870s Inland Customs Line (red) and Great Hedge (green)

Inland Customs Line

From Wikipedia, the free encyclopedia

The Inland Customs Line which incorporated the Great Hedge of India (or Indian Salt Hedge[1]) was a customs barrier built by the British across India primarily to collect the salt tax. The customs line was begun while India was under the control of the East India Company but continued into the period of direct British rule. The line had its beginnings in a series of customs houses that were established in Bengal in

1803 to prevent the smuggling of salt to avoid the tax. These customs

houses were eventually formed into a continuous barrier that was brought

under the control of the Inland Customs Department in 1843.

The

line was gradually expanded as more territory was brought under British

control until it covered a distance of more than 2,500 miles

(4,000 km), often running alongside rivers and other natural barriers.

At its greatest extent it ran from thePunjab in the northwest until it reached the princely state of Orissa, near the Bay of Bengal, in the southeast. The line was initially made of dead, thorny material such as the Indian Plum but eventually evolved into a living hedge that grew up to 12 feet (3.7 m) high and was compared to the Great Wall of China. The Inland Customs Department employed customs officers, Jemadars and

men to patrol the line and apprehend smugglers, reaching a peak of more

than 14,000 staff in 1872. The line and hedge were considered to be an

infringement on the freedom of Indians and in opposition to free tradepolicies

and were eventually abandoned in 1879 when the tax was applied at point

of manufacture. The salt tax itself would remain in place until 1946.

Contents

[hide]Origins[edit]

When the Inland Customs Line was first conceived, British India was governed by the East India Company. This situation lasted until 1858 when the responsibility for government of the colony was transferred to the Crown following the events of the Indian Rebellion of 1857. By 1780 Warren Hastings, the Company'sGovernor-General of India, had brought all salt manufacture in the Bengal Presidency under Company control.[2] This allowed him to increase the ancient salt taxin Bengal from 0.3 rupees per maund (37 kg) to 3.25 rupees per maund by 1788, a rate that it remained at until 1879.[3] This brought in a huge amount of revenuefor the company, amounting to 6,257,470 rupees for the 1784–85 financial year, at the cost of the Indian consumer, who would have to expend around 2 rupees per year (2 months' income for a labourer[contradiction]) to provide salt for his family.[4] There were taxes on salt in the other British India territories but the tax in Bengal was the highest, with the other taxes at less than a third of the Bengal tax rate.

It was possible to avoid paying the salt tax by making it illegally in salt pans, stealing it from warehouses or smuggling salt from the princely states which remained outside of direct British rule. The latter was the greatest threat to the company's salt revenues.[5] Much

of the smuggled salt came into Bengal from the west and the company

decided to act to prevent this trade. In 1803 a series of customs houses and

barriers were constructed across major roads and rivers in Bengal to

collect the tax on traded salt as well as duties on tobacco and other

imports.[6] These

customs houses were backed up by "preventative customs houses" located

near salt works and the coast in Bengal to collect the tax at source.[7]

These

customs houses alone did little to prevent the mass avoidance of the

salt tax. This was due to the lack of a continuous barrier, corruption

within the customs staff and the westward expansion of Bengal towards

salt-rich states.[7][8][9] In 1823 the Commissioner of Customs for Agra, George Saunders, installed a line of customs posts along the Ganges and Yamuna rivers from Mirzapur to Allahabad that would eventually evolve into the Inland Customs Line.[8]The

main aim was to prevent salt from being smuggled from the south and

west but there was also a secondary line running from Allahabad to Nepal to prevent smuggling from the Northwest frontier.[10] The annexation of Sindh and thePunjab allowed the line to be extended north-west by G. H. Smith, who had become Commissioner of Customs in 1834.[10][11] Smith

exempted items such as tobacco and iron from taxation to concentrate on

salt and was responsible for expanding and improving the line,

increasing its budget to 790,000 rupees per year and the staff to 6,600

men.[10] Under Smith's leadership the line saw many reforms and was officially named the Inland Customs Line in 1843.[1]

Inland Customs Line[edit]

Smith's new Inland Customs Line was first concentrated between Agra and Delhi and

consisted of a series of customs posts at one mile intervals, linked by

a raised path with gateways (known as "chokis") to allow people to

cross the line every four miles.[1][12] Policing of the barrier and surrounding land, to a distance of 10 to 15 miles (16 to 24 km), was the responsibility of the Inland Customs Department, headed by a Commissioner of Inland Customs. The department staffed each post with an Indian Jemadar (approximately equivalent to a British Warrant Officer) and ten men, backed up by patrols operating 2–3 miles behind the line.[12] The

line was mainly concerned with the collection of the salt tax but also

collected tax on sugar exported from Bengal and functioned as a

deterrent against opium, bhang and cannabis smuggling.[13][14][15]

The

end of company rule in 1858 allowed the British government to expand

Bengal through territorial acquisitions, updating the line as needed.[16] In 1869 the government in Calcutta ordered

the connection of sections of the line into a continuous customs

barrier stretching 2,504 miles (4,030 km) from the Himalayas to Orissa, near the Bay of Bengal.[16][17]This distance was said to be the equivalent of London to Constantinople.[18] The north section from Tarbela to Multan was lightly guarded with posts spread further apart as the wide Indus River was

judged to provide a sufficient barrier to smuggling. The more heavily

guarded section was around 1,429 miles (2,300 km) long and began at

Multan, running along the rivers Sutlej and Yamuna before terminating south of Burhanpur.[17][19] The final 794-mile (1,278 km) section reverted to longer distances between customs posts and ran east to Sonapur.[19]

In

the 1869–70 financial year the line collected 12.5 million rupees in

salt tax and 1 million rupees in sugar duties at a cost of 1.62 million

rupees in maintenance. In this period the line employed around 12,000

men and maintained 1,727 customs posts.[17] By 1877 the salt tax was worth £6.3 million (approx 29.1 million rupees)[20] to

the British government in India, with the majority being collected in

the Madras and Bengal provinces, lying on either side of the customs

line.[21]

Great Hedge[edit]

It is not known when an actual live hedge was

first grown along the customs line but it is likely that it began in

the 1840s when thorn bushes, cut and laid along the line as a barrier

(known as the "dry hedge", see also dead hedge), took root.[22][23] By 1868 it had become 180 miles (290 km) of "thoroughly impenetrable" hedge.[24] The original dry hedge consisted mainly of samples of the dwarf Indian Plum fixed to the line with stakes.[25] This hedge was at risk of attack bywhite ants, rats, fire, storms, locusts, parasitic creepers, natural decay and strong winds which could destroy furlongs at a time and necessitated constant maintenance.[25][26] Allan Octavian Hume,

Commissioner of Inland Customs from 1867–70, estimated that each mile

of dry hedge required 250 tons of material to construct and that this

material had to be carried to the line from between 0.25 and 6 miles

(0.40 and 9.66 km) away.[27] The

amount of labour involved in such a task was one of the reasons that a

live hedge was encouraged, particularly as damage required the

replacement of around half of the dry hedge each year.[27]

In

1869 Hume, in preparation for a rapid expansion of the live hedge,

began trials of various indigenous thorny shrubs to see which would be

suited to different soil and rainfall conditions.[28] The result was that the main body of the hedge was composed of Indian plum, babool, karonda and several species of Euphorbia.[29] The prickly pear was used where conditions meant that nothing else could grow, as was found in parts of the Hisar district, and in other places bamboo was planted.[30][31] Where

the soil was poor it was dug out and replaced or overlain with better

soil and in flood plains the hedge was planted on a raised bank to

protect it.[28][30] The

hedge was watered from nearby wells or rainwater collected in large,

purpose built trenches and a "well made" road was constructed along its

entire length.[1][28]

Hume

was responsible for transforming the hedge from "a mere line of

persistently dwarf seedlings, or of irregularly scattered, disconnected

bushes" into a formidable barrier that, by the end of his tenure as

commissioner, contained 448.75 miles (722.19 km) of "perfect" hedge and

233.5 miles (375.8 km) of "strong and good", but not impenetrable hedge.[30] The

hedge was nowhere less than 8 feet (2.4 m) high and 4 feet (1.2 m)

thick and in some places was 12 feet (3.7 m) high and 14 feet (4.3 m)

thick.[30][31] Hume himself remarked that his barrier was "in its most perfect form, ... utterly impassable to man or beast".[32]

Hume

also substantially realigned the Inland Customs Line, joining together

separate sections and removing some of the spurs that were no longer

necessary.[31]Where

this happened, whole runs of hedge were abandoned, and the men would

have to construct a hedge from scratch on the new alignment.[33] The living hedge was terminated at Burhanpur in the south, beyond which it could not grow, and at Layyah in the north where it met the River Indus, whose strong current was judged sufficient to deter smugglers.[34] Historian Henry Francis Pelham compared the use of the Indus in this way to that of the River Main, in modern Germany, for the Roman Limes Germanicus fortifications.[1]

Hume was replaced as Commissioner of Customs in 1870 by G. H. M. Batten who would hold the post for the next six years.[33] His

administration saw little realignment of the hedge but extensive

strengthening of the existing run, including the building of stone walls

and ditch and bank systems where the hedge could not be grown.[1][33] By

the end of Batten's first year he had increased the length of "perfect"

hedge by 111.25 miles (179.04 km), and by 1873 the central portion

between Agra and Delhi was said to be almost impregnable.[26][35] The line was altered slightly in 1875-6 to run alongside the newly built Agra Canal, which was judged a sufficient obstacle to allow the distance between guard posts to be increased to 1.5 miles (2.4 km).[36]

Batten's replacement as Commissioner was W. S. Halsey who would be the last to be in charge of the Great Hedge.[36]Under

Halsey's control the hedge grew to its greatest extent, reaching a peak

of 411.5 miles (662.2 km) of "perfect" and "good" live hedge by 1878

with a further 1,109.5 miles (1,785.6 km) of inferior hedge, dry hedge

or stone wall.[37] The live hedge extended to at least 800 miles (1,300 km) and in places was backed up with an additional dry hedge barrier.[37] All maintenance work was halted on the hedge in 1878 after a decision was made to abandon the line in 1879.[37][38]

Staff[edit]

The

customs line and hedge required a large number of staff to patrol and

maintain it. The majority of the staff were Indian, with their officers

coming mainly from the British. In 1869 the Inland Customs Department

employed 136 officers, 2,499 petty officers and 11,288 men on the line,

reaching a peak of 14,188 men of all ranks in 1872, after which staff

numbers declined to around 10,000 as expansion slowed and the hedge

matured.[39][40] The Indian staff were recruited disproportionately from the Muslim population, who constituted 42 percent of the customs men.[41] The

men were intentionally stationed in areas away from their home towns

which, together with their removal of local wood for the hedge, made

them unpopular among local people.[41] To

encourage co-operation, those Indians who lived in villages near the

line were allowed to carry up to 2 pounds (0.9 kg) of salt across for

free.[41]

The

job of customs man was highly desirable due to its high pay of five

rupees per month (agricultural wages were around three rupees a month),

which could be topped up with the proceeds from the sale of seized salt.[42] However

the men were forced to live away from their families in order to

minimise distractions and were not provided with houses, being expected

to build their own from mud or wood.[40][43] In

1868 the Inland Customs department allowed the men's families to join

them on the line, as the previous order had led to customs men straying

from their posts and associating too closely with local women.[43] The men worked twelve-hour days consisting of two equal day and night shifts.[44] The

principal tasks were patrolling and maintaining the hedge; in 1869

alone the customs men carried out 18 million miles (29 million km) of

patrols, dug 2 million cubic feet (57,000 cubic metres) of earth and

carried over 150,000 tons of thorny material for the hedge.[39] There

was a fairly high level of turnover in the staff; for example, in

1876-7 more than 800 men left the service. This included 115 customs men

who died on the line, 276 dismissed, 30 deserted on duty, 360 failing

to rejoin after leave and 23 removed for being unfit.[42]

The

officer corps was almost entirely British; attempts to attract Indian

men to the post proved unsuccessful, as the officers were required to be

fluent in English, and such men could easily find better paid work in

other fields.[44] The

job was tough, with each officer responsible for 100 men on 10 to 30

miles (16 to 48 km) of the line, and working through Sundays and

holidays.[39][44] The

officers undertook at least one customs excursion per day on average,

weighing and applying tax to almost 200 pounds (91 kg) of goods, in

addition to personally patrolling around 9 miles (14 km) of the line.[44] The

only other British men they would meet while on the line would

typically be officers of adjacent beats and senior officers who visited

about three times a year.[44]

Abandonment[edit]

Several

British viceroys considered dismantling the line, as it was a major

obstacle to free travel and trade across the subcontinent.[45] This

was partly due to the use of the line for the collection of taxes on

sugar (which made up 10 percent of the revenues) as well as salt,

meaning that traffic had to be stopped and searched in both directions.[43] In addition the line had created a confusing number of different customs jurisdictions in the area surrounding it. [46] The

viceroys were also displeased with the corruption and bribery which was

present in the Inland Customs system, and the way the line came to

serve as a symbol of unjust taxes (parts were set on fire during the Indian Rebellion of 1857).[14][19] However,

the government could not afford to lose the revenue generated by the

line and hence, before they could abolish it, needed to take control of

all salt production in India, so that tax could be applied at the point

of manufacture.[45]

The Viceroy from 1869 to 1872, Lord Mayo,

took the first steps towards abolition of the line, instructing British

officials to negotiate agreements with the rulers of princely states to

take control of salt production.[47] The process was speeded up by Mayo's successor, Lord Northbrook, and by the loss of revenue caused by the Great Famine of 1876–78 that reduced the land tax and killed 6.5 million people.[47][48] Having secured salt production, British India's Finance Minister, Sir John Strachey, led a review of the tax system and his recommendations, implemented by Viceroy Lord Lytton,

resulted in the increase of the salt tax in Madras, Bombay and northern

India to 2.5 rupees per maund and a reduction in Bengal to 2.9 rupees.[49] This

reduced difference in tax between neighbouring territories made

smuggling uneconomical and allowed for the abandonment of the Inland

Customs Line on 1 April 1879.[49] The tax on sugar and 29 other commodities had been abolished a year earlier.[50] Strachey's tax reforms continued, and he brought an end to import duties and almost complete free trade to India by 1880.[51] In 1882 Viceroy Lord Ripon finally standardised the salt tax across most of India at a rate of two rupees per maund.[52] However the trans-Indus districts of India continued to be taxed at eight annas (½ rupee) per maund until 23 July 1896 andBurma maintained its reduced rate of just three annas.[47][53] The equalisation of tax cost the government 1.2 million rupees of lost revenue.[54] The potential for salt to be smuggled from the Kohat (trans-Indus) region meant that the north-western section of the line, some 325 miles long from Layyah to Torbela, continued to be policed by the Department of Salt Revenue in Northern India until at least 1895.[55]

Impact on smuggling[edit]

The

principal function of the line was to prevent smuggling, often the only

way to procure affordable salt, and in this respect it was fairly

successful.[56] Smugglers

who were caught by customs men were arrested and fined around 8 rupees,

those that could not pay being imprisoned for around 6 weeks.[57] The

number of smugglers caught increased as the line was lengthened and

improved. In 1868 2,340 people were convicted of smuggling after being

caught on the line, this rose to 3,271 smugglers in 1873–74 and to 6,077

convicted in 1877–78.[42][58]

Several

methods of smuggling were employed. Early on, when patrols were patchy,

large scale smuggling was common, with armed gangs breaking through the

line with herds of salt-laden camels or cattle.[59] As

the line was strengthened, smugglers changed tactics and would try to

disguise salt and bring it through the line or throw it over the hedge.[59] Scams

were also attempted with salt being hidden within the jurisdiction of

the customs department to collect the 50 percent finders fee.[60]

Clashes

between smugglers and customs men were often violent, with the deaths

of customs men in the line of duty not being uncommon. A large incident

occurred in September 1877 when two customs men attempted to apprehend

112 smugglers and were both killed.[58] More than half of the gang were later caught and either imprisoned or transported.[61] Another customs man lost his life near Sohar when

he attempted, with seven colleagues, to capture a gang of 30 smugglers.

Fourteen of the gang were later captured and, again, imprisoned or

transported. Many of the smugglers also died, with examples including

one killed by his fellow smugglers in a fight with customs men and

another drowning while trying to escape by swimming an irrigation tank.[61]

Legacy[edit]

Writers

have described the line as infringement of the principles of free trade

and the freedom of the people of India. Sir John Strachey, the minister

whose tax review led to the abolition of the line, was quoted in 1893

describing the line as "a monstrous system, to which it would be almost

impossible to find a parallel in any tolerably civilised country".[18] This has been echoed by modern writers such as journalist Madeleine Bunting, who wrote in The Guardian in February 2001 that the line was "one of the most grotesque and least well known achievements of the British in India".[62]

The massive scale of the undertaking has also been commented upon, with both Hume, the customs commissioner, and M. E. Grant Duff, who was Under-Secretary of State for India from 1868 to 1874, comparing the hedge to the Great Wall of China.[1][30] The

abolition of the line and equalisation of tax has generally been viewed

as a good move, with one writer of 1901 stating that it "relieved the

people and the trade along a broad belt of country, 2,000 miles long,

from much harassment".[53] Sir Richard Temple, governor of the Bengal and Bombay Presidencies,

wrote in 1882 that "the inland customs line for levying the salt-duties

has been at length swept away" and that care must be taken to ensure

that the "evils of the obsolete transit-duties" did not return.[63]

The

use of the customs line to maintain the higher salt tax in Bengal is

likely to have had a detrimental effect on the health of Indians

through salt deprivation.[64]The

higher prices within the area enclosed by the line meant that the

average annual salt consumption was just 8 pounds (3.6 kg) compared with

up to 16 pounds (7.3 kg) outside the line.[65] Indeed

the British government's own figures showed that the barrier directly

affected salt consumption, reducing it to below the level that

regulations prescribed for English soldiers serving in India and that

supplied to prisoners in British jails.[66] The consumption of salt was further lowered during the periods of famine that affected India in the 19th century.[67]

It

is impossible to know how many died from salt deprivation in India as a

result of the salt tax as salt deficiency was not often recorded as a

cause of death and was instead more likely to worsen the effects of

other diseases and hinder recoveries.[67] It

is known that the equalisation of tax made salt cheaper on the whole,

decreasing the tax imposed on 130 million people and increasing it on

just 47 million, leading to an increase in the use of the mineral.[68] Consumption

grew by 50 percent between 1868 and 1888 and doubled by 1911, by which

time salt had become cheaper (relatively) than at any earlier stage of

Indian history.[69]

It

is impossible to know how many died from salt deprivation in India as a

result of the salt tax as salt deficiency was not often recorded as a

cause of death and was instead more likely to worsen the effects of

other diseases and hinder recoveries.[67] It

is known that the equalisation of tax made salt cheaper on the whole,

decreasing the tax imposed on 130 million people and increasing it on

just 47 million, leading to an increase in the use of the mineral.[68] Consumption

grew by 50 percent between 1868 and 1888 and doubled by 1911, by which

time salt had become cheaper (relatively) than at any earlier stage of

Indian history.[69]

The

rate of salt tax was increased to 2.5 rupees per maund in 1888 to

compensate for the loss of revenue from falling silver prices, but this

had no adverse effect on salt consumption.[54] The salt tax remained a controversial means of collecting revenue and became the subject of the 1930 Salt Satyagraha, a civil disobedience movement led by Mohandas Gandhi against British rule. During the Satyagraha Gandhi and others marched to the salt producing area of Dandi and defied the salt laws, leading to the imprisonment of 80,000 Indians. The march drew significant publicity to the Indian independence movement but failed to get the tax repealed. The salt tax would finally be abolished by the Interim Government of India, led by Jawaharlal Nehru, in October 1946.[70] The government of Indira Gandhi overlaid much of the old route with roads.[71]

Rediscovery[edit]

Despite

its scale, the customs line and associated hedge were not widely known

in either Britain or India, the standard histories of the period

neglecting to mention them.[32] Roy Moxham, a conservator at the University of London library,

wrote a book on the customs line and his search for its remains that

was published in 2001. This followed his finding, in 1995, of a passing

mention of the hedge in Major-General Sir W.H. Sleeman's 1893 work Rambles and Recollections of an Indian Official.[32] Moxham looked up the hedge in the India Office Records of the British Library and determined to locate its remnants.[72]

Moxham conducted extensive research in London before making three trips to India to look for any remains of the line.[73] In 1998 he located a small raised embankment in the Etawah district in Uttar Pradesh which may be all that remains of the Great Hedge of India.[74] Moxham's

book, which he claims to be the first on the subject, details the

history of the line and his attempts to locate its modern remains.[73] The book was translated into the Marathi language by Anand Abhyankar and published in 2007.[75] Cyril Alex translated into Tamil and was published in 2015, personally attended by Roy Moxham himself.

Gandhi on the Salt March to Dandi of March 1930

..............................................................................

Click Here to Apply the Mizoram Psc recruitment

ReplyDeleteapply here rmsa assam recruitment